The outbreak of coronavirus in mainland China has crippled business operations across the country as the central government scrambles to control the spread, including ordering lockdowns of a number of cities. In Hong Kong, many companies have also implemented health and safety measures for staff in the wake of the epidemic.

This article discusses the general obligations of employers during the outbreak of infectious disease, possible measures they can adopt and potential liabilities on failure to do so.

1. Current measures put in place by the government and corporations in Hong Kong

The SAR government has advised that government employees could work from home depending on the departmental arrangements. A host of government services, including court hearings, are suspended for the time being.

In an effort to contain the spread of the coronavirus, the SAR government also ordered closing of all the city’s border crossings, except for the Hong Kong-Zhuhai-Macau Bridge, the Shenzhen Bay Port and the airport and has implemented, with effect from 8 Feb 2020, a mandatory 14-day quarantine for all persons (including Hong Kong residents) arriving in Hong Kong from mainland China.

Many Hong Kong corporations have taken similar measures to allow staff the flexibility of home office. Local banks have also closed a substantial number of branch operations to avoid the spread of the coronavirus. In the retail and food and beverage industries, where provision of services must be maintained, service providers have stepped up on precautionary measures, such as wearing masks carrying out more frequent cleanings.

2. General obligations on employers

Under common law, an employer has an implied duty to provide a safe working environment. This means that an employer must take reasonable steps to ensure that the equipment, premises and systems of work used in its place of business are safe1.

Legislation-wise, the Occupational Safety and Health Ordinance (“OSHO”) imposes a duty on employers to ensure safety and health of employees at work2while the Factories and Undertakings Ordinance has specific application to industrial work environments.

Employers should take steps to maintain any workplace under their control in a condition that is safe and without health risks as far as reasonably practicable. The obligation also includes provision of information, precaution instructions and safety device and equipment as may be necessary to ensure employees have the means and knowledge to work healthy and safely.

The law does not require employers to absolute ensure health and safety in the workplace, but only to the extent that such measures are reasonably practicable and have been duly performed.

In complying with statutory obligations, employers should issue health and safety guidelines to staff, reminding them of proper precautionary measures to take to protect themselves against infections, such as personal hygiene and correct use and disposal of masks etc.

Frontline staff having close interactions with mass customers or higher chance to be contaminated with virus due to the environment (e.g. cleaners) should be provided with necessary safety equipment at work, e.g. surgical masks, hand sanitizers and hand gloves.

In the view of outbreak of a dreadful virus, the employers shall also consider the need for face-to-face working arrangements, like internal and external meetings and the general hygiene and cleanliness of the workplace.

3. Non-compliance issue and potential liabilities

Employers intentionally or recklessly fails to provide a safe workplace without health risks may be made liable on conviction to a fine of $200,000 and imprisonment for 6 months3.

It is important for companies to build and maintain a good reputation for business sustainability and be socially responsible. To this end, any failure to ensure staff safety and health may cause erosion of trust in employees, damaging morale in the office and adversely affecting business efficiency.

It can be equally, if not more, destructive to business if clients or consumers consider a business is neglecting social responsibility and staff care and support. To maintain clients’ and employees’ loyalty, companies should be mindful of the messages they send to the public, usually by social media, in the court of putting measures in place.

4. What can be done but also maintain works and services?

As far as it is practicable, companies should consider contingency plans which may include the flexibility to allow employees to work from home and reduce the need for physical meetings.

For critical roles that must be performed in office, reduced headcount by way of shifts could be a solution.

Home office can only be effective if employees are provided with necessary tools to work from home, including efficient communication channels, and there are instructions and procedural guidelines on what employees should do and how they can report. it is essential for the supervisors and subordinates to have regular interval update or communications to ensure works and services are maintained.

There should also be reporting requirements on employees to disclose any travel history where necessary and liaise with management for self-quarantine in order to safeguard the health and safety of co-workers.

5. Some Q&As for the employers

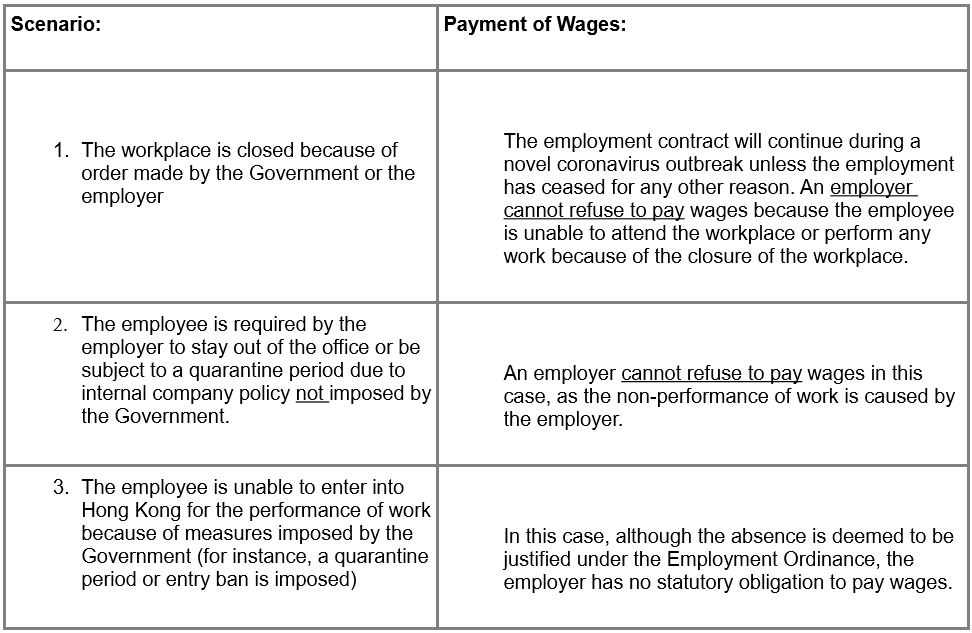

i. Do I have to continue to pay wages and benefits during the novel coronavirus outbreak?

Yes, but it depends:

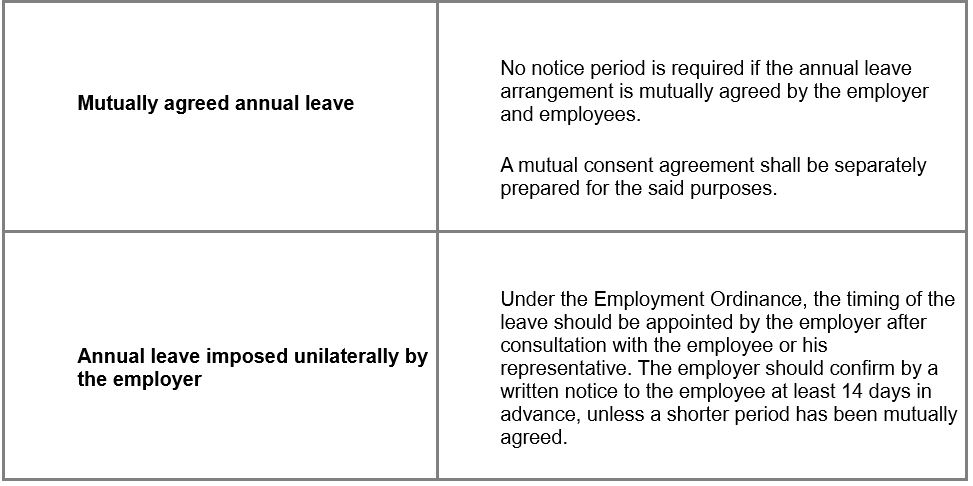

ii. Can I impose annual leave on my employees?

Yes, but it depends:

iii. Can I impose unpaid leave on my employees?

Unpaid leave cannot be imposed by the employer, unless otherwise agreed by the employees.

iv. Can I require my employees and clients to have their temperature tested or wear masks before allowing them to enter the workplace?

It is generally lawful for an employer to ask its employees and clients to undergo a temperature test or wear face masks on a voluntary basis if there is a reasonable basis for doing so.

The screening of employees and clients would likely be considered a reasonable step for an employer to take to reduce the risk of its employees and visitors to the workplace being exposed to harm, given the fact that an employer has the statutory obligation to maintain a healthy and safe workplace. In principle, an employer may reasonably deny access to the workplace for employees or clients who do not comply with such requirement.

Temperature testing may, however, raise issues of data privacy. As such, employers should be mindful of the data protection rules in relation to the purpose and manner of the collection of such data.

We are happy to discuss with employers further on the practical health and safety precautions during the outbreak of infectious diseases.

This article is for reference only. Nothing herein shall be construed as any formal legal advice for that matter to any person. Oldham, Li & Nie shall not be held liable for any loss and/or damage incurred by any person acting as a result of the materials contained in this article.

If you have any question regarding the topic discussed or on other employment issues, please contact victor.ng@oln-law.com.

1 Wong Wai Ming v Hospital Authority [2001] 3 HKLRD 209

2 Section 6(1), OSHO.

3 Section 6(4), OSHO.

Suite 503, 5/F, St. George's Building, 2 Ice House Street, Central, Hong Kong

Suite 503, 5/F, St. George's Building, 2 Ice House Street, Central, Hong Kong +852 2868 0696

+852 2868 0696