With Hong Kong being a signatory to the Multilateral Competent Authority Agreement on Automatic Exchange of Financial Account Information (“MCAA on AEOI”) and the Convention on Mutual Administrative Assistance in Tax Matters (“Convention”) entering into force in Hong Kong, Hong Kong has started exchanging financial account information with 41 jurisdictions commencing from 1 September 2018, including United Kingdom, France, Germany, Australia, Canada, Singapore and Japan.

This means the information of account holders who are subject to taxation as a resident in other jurisdictions other than Hong Kong including interest income, dividend income, gross proceeds from the sale of financial assets would be provided to the tax authorities of the other jurisdictions under the Automatic Exchange of Financial Account Information (“AEOI”) regime. Please refer to our Article “Is your personal data at stake because of the increased transparency in tax administration through Automatic Exchange of Information?” for a detailed discussion of the AEOI regime.

How it works?

(1) The Hong Kong Inland Revenue Department (“IRD”) has established a dedicated platform, i.e., the AEOI Portal, for reporting financial institutions (“FIs”) to electronically submit notifications and furnish Financial Account Information Returns for reporting the required information of reportable accounts.

(2) The IRD will exchange the financial account information collected from the reporting FIs with relevant jurisdictions via the Common Transmission System established by the OECD.

OLN’s observation

In the past Hong Kong had relied on a bilateral approach which involves signing bilateral Competent Authority Agreements (“CAA”) for AEOI with other jurisdictions that already have a comprehensive avoidance of double taxation (“CDTA”) or a tax information exchange agreement (“TIEA”) with Hong Kong. As at 13 September 2018, Hong Kong had 40 CDTAs and 7 TIEA, and signed 16 bilateral CAAs for AEOI. Hong Kong’s move of being a signatories to MCAA on AEOI and having the Convention entering into force in Hong Kong has demonstrated Hong Kong’s commitment to enlarging the scope of the exchange of tax information in the international community and to comply with the OECD’s requirement to have the first exchange of AEOI with a wide network of partners by September 2018.

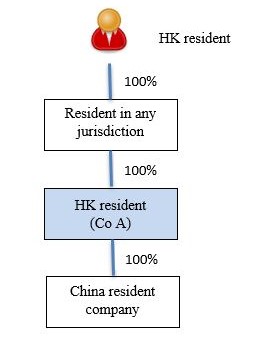

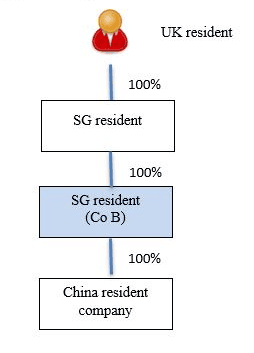

With the continuous trend of the exchange of tax information between the tax authorities, taxpayers, in particular for the taxpayers that have presence in various jurisdictions, should carefully assess their tax obligations to ensure compliant with the tax laws of the relevant jurisdictions.

OLN is equipped to advise clients on tax issues arising from various jurisdictions. If you have any questions regarding the above or on any tax issues, please contact one of the members of the tax advisory team.

香港中環雪厰街二號聖佐治大廈五樓503室

香港中環雪厰街二號聖佐治大廈五樓503室 +852 2868 0696

+852 2868 0696