~討論跨國公司應如何應對經合組織就自動信息交換及轉讓定價問題的新措施~

AEOI和CRS –對逃稅的收緊控制措施

隨着世界全球化,跨境經濟活動近幾十年來已成常態。從前,跨國公司(MNC)會採取較進取的稅務策略,將其公司利潤大部分藏於避稅天堂內。由於這些避稅天堂過往很少與外國稅務機關分享資料,因此世界各國的稅務部門往往難以搜集納稅人的離岸資產和交易資料及在其國家管轄範圍內針對有關納稅人進行稅收評估。為堵塞這些漏洞,經合組織開始率領國際實施自動信息交換(Automatic Exchange of Information (AEOI))和採用通用報告標準(Common Reporting System (CRS))。

為確保參與國能在信息分享交換上互惠互利,參與國的金融機構必須定期向當地稅務機關提供財務信息,然後將其轉交至海外稅務機關,以換取其他參與國司法管轄區所提供的相關信息。值得注意的是,截至2020年6月,已有100多個司法管轄區同意實施AEOI。

政策對我有什麼影響?

假設您是國家A的稅務居民,並且在國家B擁有離岸資產或收入。如果兩個國家都承諾遵守AEOI,國家B將有義務向國家A的稅務部門自動分享您的財務信息,以便該稅務部門追縱您的跨國境外投資,並進行避稅調查和執行違規行為。在新的披露制度下,涵蓋的信息包括稅務申報和財務報表、公司董事/股東、公司註冊、權益、股息、賬戶餘額、金融資產的銷售收益等,令透過非披露(non-disclosure)作避稅的方法極為困難,而納稅人居住地亦會針對其離岸而未申報的金融資產作出調查。

香港於2016年已就《稅務條例》進行修訂,以提高稅收透明度和打擊跨境逃稅。香港政府與合作管轄區夥伴之間訂立了雙邊協議後,雙方便可進行有關信息交換。直至2020年初,香港須報告的管轄區已增加到126個,法律亦要求香港的金融機構收集個人/公司賬戶持有人的信息及其金融賬戶信息,以便與其他管轄區進行信息交換。此外,香港的金融機構必須要求帳戶持有人填寫自我證明表格(self-certification form)以宣告其稅務居民身份,任何蓄意就居民身份作出虛假陳述的人士都有可能須負上刑事責任。

由於AEOI制度相對較新, 有關CRS制度下的潛在缺陷的新聞時有報導。例如,許多離岸司法管轄區仍未有公眾公司查冊制度,而最終受益人身份亦可能無法確定。但是,隨著CRS制度日益完善,過去透過離岸公司用作保密的做法將被逐步淘汰。

重點

隨着全球稅務透明度提高,公司內部的法律專業人士應在實施任何跨境交易(尤其當某些離岸金融信息可能會被披露並向其本國機關報告)前,向他們的稅務顧問徵詢意見。值得留意的是,它們可能不再基於保密或客戶機密的原因而受到保護。此外,由於AEOI制度可能會在某些司法管轄區起追溯作用,因此,有外國業務的公司也應審查過往的交易,並確保已經充分披露有關稅務資料,以避免因為將來面對調查而受罰。

轉讓定價是如何運作?

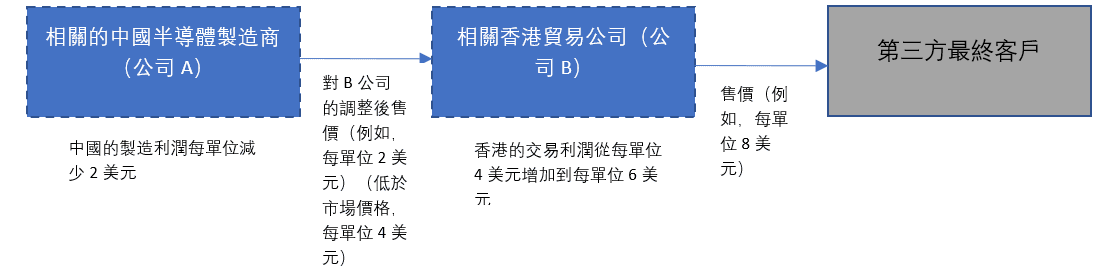

如上所述,稅務機關會經常密切注視跨國公司,確保其運作不會將其利潤轉移到海外公司。“轉讓定價”是一種經常會受到挑戰和審查的稅務策略。跨國公司可透過“轉讓定價”人為地確定關聯公司之間的定價,以降低整個集團的稅務負擔。當一間公司位於高稅率管轄區而另一家關聯海外公司處於低稅率管轄區時,轉讓定價是一種常見的安排。試想像,當公司A是一間中國半導體製造商,而公司B是一家在香港成立促進全球銷售的貿易公司,集團便有機會通過壓低公司A的產品價格來操縱關聯公司間的定價,令集團的製造利潤的一部分在出售予第三方最終客戶前從中國轉移到香港,並享受香港更優惠的稅率。以下圖表解釋這種情況。

世界各地的稅務機關已積極採取措施透過反避稅立法防止人為價格操縱以打擊其徵稅收入。雖然各個司法管轄區的立法細節或有所不同,其共同目標均是以公平交易(arm’s length)為原則,要求定價按非關聯方間進行的交易釐訂。我們以下將簡介香港有關轉讓定價的法律和實務的最新情況。

香港的轉讓定價(TP)

在2018年的立法修訂前,《稅務條例》第20條(現已廢除)是一條過往長期被用作處理轉讓定價問題的法律。根據該條文,如果一個非香港居民與一個與它有密切聯繫的居民展開業務,而這些業務的安排導致該香港居民沒有產生香港利潤或低於一般交易的利潤,該非香港居民的業務將會因被視為在香港展開業務而被香港當局徵稅。現時,香港的轉讓定價問題主要按第50AAF條連同其他反避稅條款來處理。如果兩個關聯方之間的交易(i)有異於兩個獨立個體之間的交易和(ii)賦予潛在的香港稅收利益,該條文則授權香港稅務局按公平交易原則對收入或支出進行轉讓定價的調整。這原則與經合組織的《2017 OECD移轉訂價報告指導原則》(2017年7月發布)對應,並從2018年4月1日(即2018/19稅務年度)起開始生效。值得注意的是,納稅人有責任證明交易是否以公平交易進行,如果他們不能滿足香港稅務局的要求,稅務局可能會做出相應的轉讓定價調整。

三層架構的轉讓定價文件

總體檔案和分部檔案

縱使新法律已經出台,我們了解到香港的一些企業並未得悉他們可能須符合三層架構的轉讓定價文件要求。事實上,自2018年4月起,香港稅務局會要求任何從事關聯交易的香港實體準備一個總體檔案(Master File)和一個分部檔案(Local File)。它們必須在提交報稅表時披露他們是否需要準備任何轉讓定價相關的文件。然而,如果某實體在一個指定的會計期間至少符合以下兩個豁免標準,則可獲豁免擬備有關文件。

• 跨國公司集團的總收入不超過4億美元。

• 資產總價值不超過3億美元;和/或

• 平均僱員人數不超過100人。

此外,如果相關的關聯交易不超過以下金額,香港公司就不需要準備分部檔案。

• 物業轉讓(無論是動產還是不動產,但不包括金融資產和無形資產) – 2.2億港元。

• 金融資產的交易 – 1.1億港元。

• 無形資產的轉讓 – 1.1億港元;以及

• 其他交易 – 4400萬港元。

香港稅務局已經發表了《釋義及執行指引》第58號,訂下了總體檔案和分部檔案的詳細內容。例如,總體檔案必須包含公司集團的概況(包括全球業務的運營和轉讓定價政策),以便香港稅務局評估任何重大的貿易風險。至於分部檔案方面,公司必須記錄企業在每個司法管轄區內的詳細交易的轉讓定價信息,包括交易細節、涉及金額和與這些交易有關的轉讓定價可比性分析。

國別報告

若然跨國公司集團在上一個會計期間的綜合集團收入至少為68億港元,而該集團在兩個或更多司法管轄區擁有組成實體或業務,那麼該集團亦必須提交一份國別報告。該報告應包括全球收入分配、已繳稅款以及跨國企業集團經營的稅收管轄區之間的經濟活動位置的某些指標。

轉讓定價可比性分析

該原則規定了五種轉讓定價方法,以便進行可比性研究時確定關聯交易是否符合公平交易原則。確定合適的轉讓定價分析方法是一項非常技術性的工作,此分析已超出了本文的範圍。然而,律師需要注意,稅務顧問通常會根據納稅人所從事的行業或商業活動利用外部數據庫進行財務數據的搜尋,並確立與同一國家內關聯交易可相比較的數據,如沒有相關數據的話,則會使用亞洲或世界其他地區類似市場以作比較。在許多情況下,四分位數範圍等統計學概念會被用作確定關聯交易是否符合公平交易原則。

懲罰

考慮到轉讓定價的不精確性,香港稅務局已將懲罰上限訂低於其他違反稅例的水平,對不遵守該規則的處罰限於少繳稅款的100%(而不是3倍)。如果納稅人已作出合理的努力來確定公平交易的金額,則不會被徵收額外的稅款。香港稅務局亦認為,準備一份帶有可比性分析的分部檔案將被視為這方面的合理努力,而漏報或少報收入的處罰則較為嚴厲。

重點

對香港稅務局而言,確定哪些公司有義務提交轉讓定價文件並不困難。 很多時候,由於香港稅務局並未向納稅人提出要求,企業並沒有意識到新法規對他們的直接影響。 因此,除非法定豁免範圍適用,跨國公司可能會因不遵守有關規定而誤墮法網。 因此,我們建議他們在進行有關關聯交易前儘早作出準備。鑑於上述涉及技術性問題,公司應徵詢會計和法律專家的意見以減低轉讓定價潛在的風險。

香港中環雪厰街二號聖佐治大廈五樓503室

香港中環雪厰街二號聖佐治大廈五樓503室 +852 2868 0696

+852 2868 0696