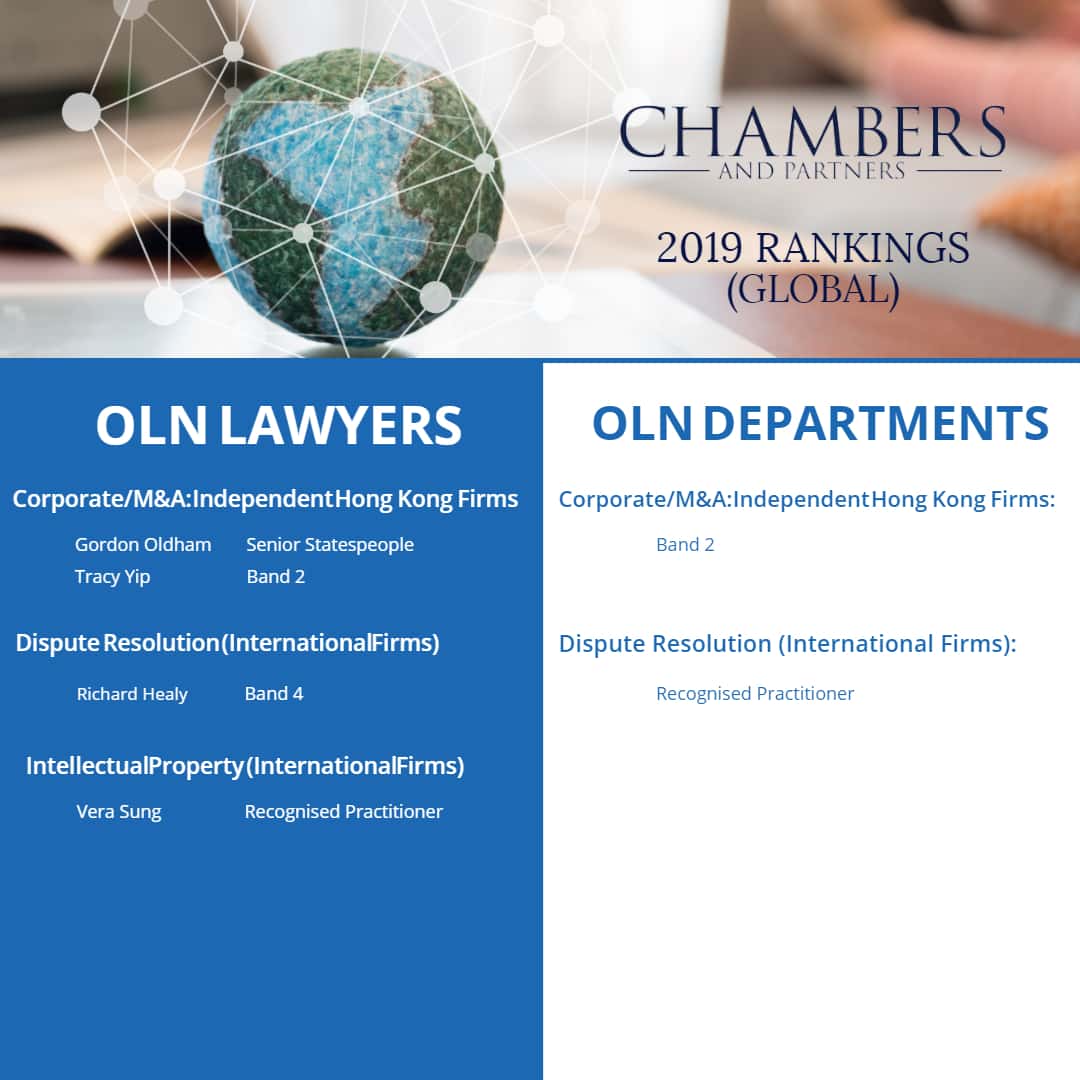

We are glad to announce OLN departments and lawyers have been ranked in Chambers Global and Asia Pacific 2019.

Chambers Global

Departments:

- Corporate / M&A: Independent Hong Kong Firms – Band 2

- Dispute Resolution (International Firms) – Recognised Practitioner

Lawyers:

- Gordon Oldham, Corporate / M&A – Senior Statespeople

- Tracy Yip, Corporate / M&A – Band 2

- Richard Healy, Dispute Resolution – Band 4

- Vera Sung, Intellectual Property – Recognised Practitioner

Chambers Asia Pacific

Departments:

- Corporate / M&A: Independent Hong Kong Firms – Band 2

- Dispute Resolution: Litigation (International Firms) – Recognised Practitioner

- Employment: Hong Kong Law (International Firms) – Band 3

- Family / Matrimonial (International Firms) – Band 3

Lawyers:

- Gordon Oldham, Corporate / M&A – Senior Statespeople

- Tracy Yip, Corporate / M&A – Band 2

- Richard Healy, Dispute Resolution: Litigation – Band 4

- Stephen Peaker, Family / Matrimonial – Band 3

- Vera Sung, Intellectual Property – Recognised Practitioner

About Chambers Rankings

Chambers rankings offer reliable recommendations on the best law firms and lawyers around the globe and in Asia-Pacific. Chambers has been the leading source of legal market intelligence for over 30 years now. Especially in the Asia-Pacific-wide rankings it covers the most internationally important areas of law, such as Arbitration, Capital Markets, and Corporate / M&A.

香港中环雪厂街二号圣佐治大厦五楼503室

香港中环雪厂街二号圣佐治大厦五楼503室 +852 2868 0696

+852 2868 0696