With the advance of technology, a lot of audit firms have been using Robotic Process Automation (RPA) in auditing. However, notwithstanding the advantages brought along by RPA, audit firms would at the same time be exposed to certain legal risks.

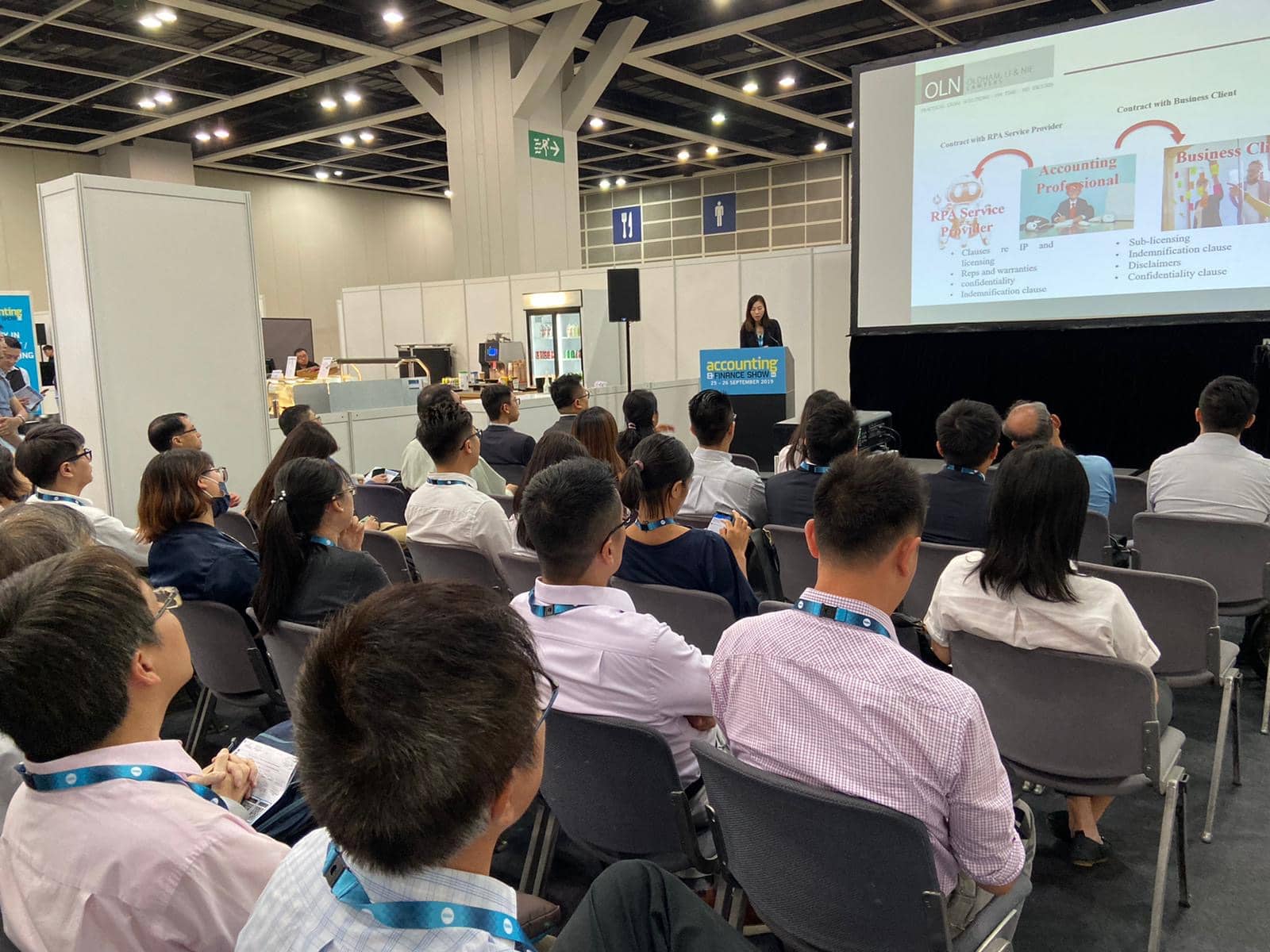

Anna Chan, Head of Tax Advisory, Partner, has recently given a talk at the Accounting & Finance Show HK 2019 on legal challenges relating to Robotic Process Automation (RPA) in accounting. The seminar focused on different means to mitigate legal risks in using RPA and demonstrated how audit firms can protect themselves through careful drafting of agreements in the aspects of intellectual properties issue, the liabilities allocation, data privacy and confidentiality.

The seminar was a great success with over 50 delegates from the Accounting and Finance industry attended.

Suite 503, 5/F, St. George's Building, 2 Ice House Street, Central, Hong Kong

Suite 503, 5/F, St. George's Building, 2 Ice House Street, Central, Hong Kong +852 2868 0696

+852 2868 0696