Oldham, Li & Nie Solicitors and Watson & Band are pleased to jointly announce their formal association which significantly expands their Legal Service Network from 2020.

OLN is a leading legal practice established in Hong Kong in 1987. Over the years, OLN has expanded into an ever-growing team of 40 plus lawyers admitted to one or more jurisdictions, including Hong Kong, France, The United Kingdom, The United States of America, Australia and Canada and covering various legal practices. It has continued to expand its business by opening a branch in Shanghai in 2007 to serve its China clientele.

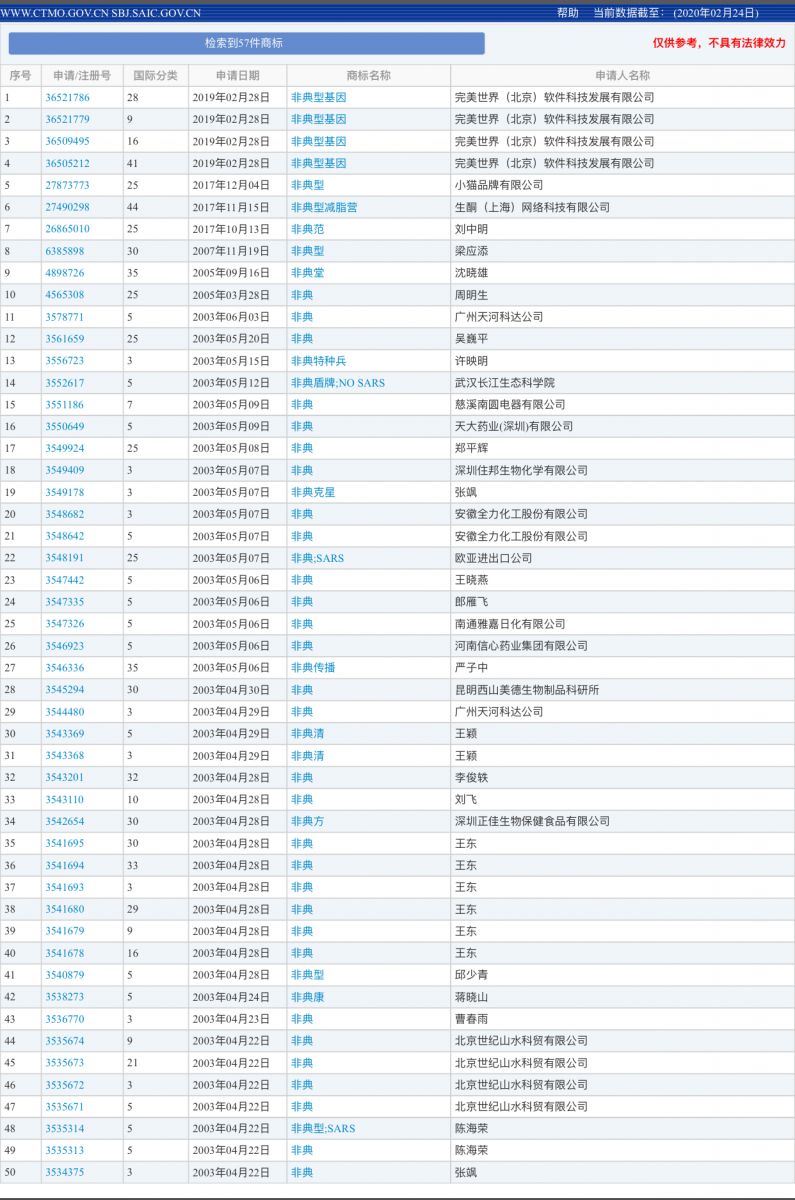

The current scope of practice of the Firm includes China Practice, Corporate and Commercial Law, Dispute Resolution, Employment and Business Immigration Law, Family Law, French Practice, Insolvency Law, Insurance Law, Intellectual Property Law, Japanese Practice and Tax Advisory. With a combination of professionalism, pragmatism, cross-border skills, local knowledge, and a results-oriented approach, OLN has served clients from publicly listed companies, developers, banks, private companies, and individuals, to government bodies.

Watson & Band (華誠律師事務所) is one of the top full-service law firms in the People’s Republic of China with more than 300 professionals in China. Founded in 1995, Watson & Band is headquartered in Shanghai having its offices in Beijing, Guangzhou, Chengdu, Zhengzhou, Suzhou, Harbin, Lanzhou, Yantai, Chizhou and Tokyo.

Watson & Band’s practice covers Intellectual Property, Big Data Law, Foreign and Domestic Investment, Corporate and Commercial, Financial and Tax, Security Law, Employment, Insolvency and Bankruptcy, Wealth Management and Family, Anti-Counterfeiting Practice, Fair Trade Practice, and Dispute Resolution. With its motto of Integrity, Strategy, Professionalism, and Dedication, Watson & Band provides client-oriented services with pragmatic solutions to its clients mostly from multinational and Fortune 500 companies, publicly listed international, state-owned and/or private companies, banks and financial institutions, real estate developers, individuals, NGOs, and government organizations.

The new Association will strengthen OLN’s China Legal Service Network and Watson & Band’s international practice, allowing the Association strategic and direct access to lawyers in different jurisdictions. With a deeper understanding of clients’ needs and behaviour, it will complement the ambitious growth of OLN and Watson & Band to provide high-quality legal services on a global scale.

In addition, OLN now stands in a strong unique position to provide professional legal services for domestic, regional and international clients by entering the Chinese market network while the Association strengthens Watson & Band’s capability to deliver its legal services internationally. With the steady demand of business flow between the two jurisdictions, the Association sets a solid foundation to empower OLN and Watson & Band to approach clients uniquely with both a domestic and global perspective. We thank our clients for their continued support and encouragement over the years.

Suite 503, 5/F, St. George's Building, 2 Ice House Street, Central, Hong Kong

Suite 503, 5/F, St. George's Building, 2 Ice House Street, Central, Hong Kong +852 2868 0696

+852 2868 0696