How to be Eligible for the Treaty Benefits for China-sourced Passive Income under the New Rules?

14 Aug 2018

The State Administration of Taxation of China (“SAT”) recently released Public Notice [2018] No. 9 (“Public Notice 9”) which provides additional guidance in assessing the beneficial ownership for treaty purposes to be aligned with the international standards.

Impact of Public Notice 9

Public Notice 9 replaces Guoshuihan [2009] No. 601 (“Circular 601”) and Public Notice [2012] No. 30 (“Public Notice 30”) and has come into effect from 1 April 2018. The impact of Public Notice 9 are as follows:-

| (i) Amendments to the unfavourable factors as listed in Circular 601 | (ii) Extension to the Safe Harbour Rule for dividends as listed in Public Notice 30 |

| Distribution of income: The recipient of the income is obligated to distribute more than 50% of such income (as opposed to 60% as stated in Circular 601) to a resident(s) of a third jurisdiction within 12 months after the receipt of such income.In addition, the term “obligated” is now more broadly defined as “including having contractual obligation or actual payment even if no contractual obligation” | the following recipients of China-sourced dividends will automatically recognized as beneficial owners without the need to undergo an assessment based on the unfavourable factors:-(1) Government of the contracting state (an extension from Public Notice 30);(2) Company that is a resident of the contracting state and listed in the contracting state;(3) Individual who is a resident of the contracting state (an extension from Public Notice 30); and(4) Recipient that is directly or indirectly wholly owned by one or more parties listed above. In cases of indirect ownership, the intermediary shareholders must be either Chinese residents or residents of the contracting states (unless it falls into either the “same country rule” or “same treaty benefit rule” as detailed below). |

| Substantive business activities: Public Notice 9 now broadly states that it would be an unfavourable factor if the business activities conducted by the recipient of the income do not constitute substantive business activities, which is determined based on the functions performed and the risks assumed by the recipient | |

| No tax in residence jurisdiction: Same as Circular 601, the income is not subject to tax or it would be taxed at a very low effective tax rate in the residence jurisdiction of the recipient | |

| Existing of another loan agreement: Same as Circular 601, in addition to the relevant loan agreement of which interest is derived, the creditor has another loan agreement or deposit agreement with a third party with similar terms such as the loan amount, interest rate and date of execution | |

| Existing of another agreement regarding ownership or right to use: Same as Circular 601, in addition to the relevant agreement in relation to copyright, patents or technology etc. of which royalty is derived, the recipient of the royalty has another agreement with a third party regarding the ownership or right to use the relevant copyright, patents or technology etc. (this factor remains the same as the one listed in Circular 601) |

Our observations and application

The extension of the safe harbour rule provides more certainty to dividend recipients without the need to undergo the assessment based on the unfavourable factors as SAT considers that there should be less risk in treaty abuse.

For example, entities / individuals can now enjoy treaty benefits under the introduction of the “same country rule” or “same treaty benefit rule” as detailed below:-

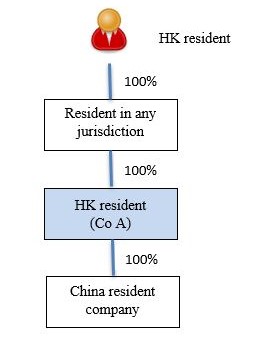

(1) Same country rule

Even if the recipient of the dividend (i.e., Co A) does not qualify as a beneficial owner because of the unfavourable factors, if the ultimate owner are in the same jurisdiction as Co A, Co A would be qualified as a beneficial owner. The jurisdiction(s) of the intermediary shareholder(s) would not be taken into account.

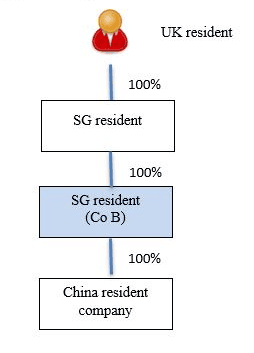

(2) Same treaty benefit rule

If the recipient of the dividend (i.e., Co B) and the ultimate owner are in different jurisdictions, even if Co B does not qualify as a beneficial owner because of the unfavourable factors, if the ultimate owner and all of the intermediary shareholder(s) are entitled to the same or a better treaty benefit than Co B, Co B would be qualified as a beneficial owner.

However, the unfavourable factors now have more stringent requirementsin place. For example:-

– the percentage of the income to be distributed has now dropped from 60% to 50%;

– the term “obligated” is explicitly defined in Public Notice 9 as “including having contractual obligation or actual payment even if no contractual obligation”; and

– replacing the factor that “the recipient conducts no or very few other business activities” to “do not constitute substantive business activities”.

Entities / individuals with China-sourced passive income should carefully review their existing investment structures to ensure that they could enjoy or continue to enjoy the treaty benefits under Public Notice 9.

OLN provides a full range of tax advisory services. If you have any questions regarding the above or on any tax issues, please contact one of the members of the tax advisory team.

Recent News

Are You Ready for Madrid?

24 Feb 2026

Suite 503, 5/F, St. George's Building, 2 Ice House Street, Central, Hong Kong

Suite 503, 5/F, St. George's Building, 2 Ice House Street, Central, Hong Kong +852 2868 0696

+852 2868 0696